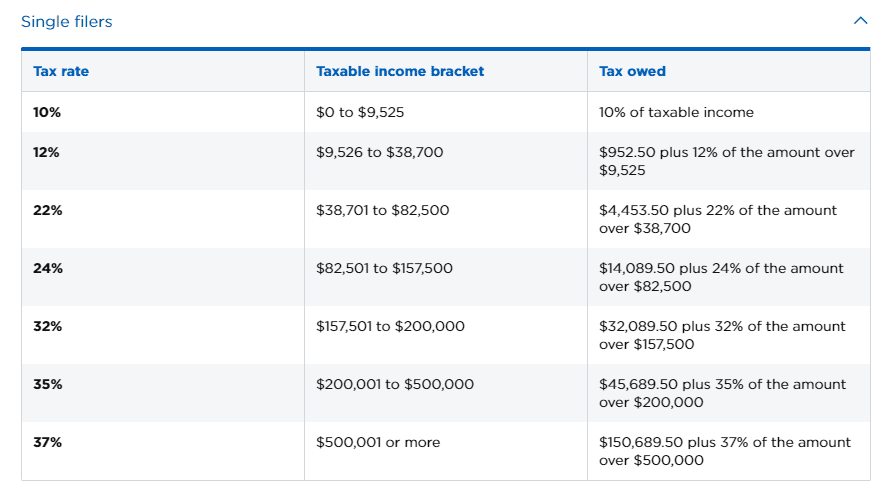

Most states have state tax brackets that tax income similar to the federal tax bracket approach, but state tax brackets are different from and generally lower than the federal ones. Adjustments to income, the standard deduction, and tax credits affect the final amount of tax to be paid. There are currently 7 income tax brackets/rates for each federal filing status: 10, 12, 22, 24, 32, 35, and 37. Taxable income and the brackets a taxpayer's income fall under depend on both income and deductions. Your marginal income tax bracket basically represents the highest tax rate that you must pay on your income. The major provisions follow, excluding those.

The new tax law made substantial changes to the tax rates and the tax base for the individual income tax. Almost all these provisions expire after 2025, while most business provisions are permanent. Their effective tax rate is lower than the top tax bracket the taxpayer is in (22%), which is referred to as their marginal rate. The Tax Cuts and Jobs Act made significant changes to individual income taxes and the estate tax. When this amount is divided by taxable income, that percentage is approximately 16%, which is referred to as the effective tax rate. Example 2: If you had 50,000 of taxable income, youd pay 10 on that first 9,525 and 12 on the chunk of income between 9,526 and 38,700. The total tax would be the sum of the amounts above, or $13,348.

#FEDERAL TAX BRACKETS PLUS#

10% on income up to $9,950 ($995), plus Although income taxes on wages are generally withheld using the IRS percentage method and the Minnesota (or other state) rate.If a single filer earned $80,000 in 2021, they would pay:

#FEDERAL TAX BRACKETS HOW TO#

Here is an example of how to calculate your tax liability using the US tax brackets. They announced the following 2022 tax brackets in November 2021 for tax returns filed in 2023 for single and married filing separately filers (and married couples filing jointly): The IRS revises the federal tax brackets to address the annual effects of inflation.

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 41,675 for single and married filing separately, 83,350 for married filing jointly or qualifying surviving spouse or 55,800 for head of household. This approach is referred to as a progressive tax system. Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15 for most individuals. As a result, as taxpayer income increases, it is taxed at higher rates, and taxpayers with lower income pay taxes at lower rates. Federal income tax brackets indicate the rate of tax for each level of taxable income for each filing status. 2021 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households Tax Rate For Single Filers, Taxable Income For Married Individuals Filing Joint Returns, Taxable Income For Heads of Households, Taxable Income 10: Up to 9,950: Up to 19,900: Up to 14,200: 12: 9,951 to 40,525: 19,901. In the U.S., the government taxes different levels of income at different rates.

0 kommentar(er)

0 kommentar(er)